Planning for financial stability during retirement is essential for enjoying a comfortable and worry-free future. Understanding the various senior financing options helps individuals make informed decisions and secure resources to cover living expenses, healthcare, and leisure activities. Here’s a comprehensive overview of financing options available for seniors.

Social Security Benefits

Social Security is a primary source of income for many retirees. These benefits are based on lifetime earnings and can provide a steady monthly income. It’s essential to plan for when to start collecting benefits, as delaying until the age of 70 can increase the monthly benefit amount.

Pension Plans

Some individuals may receive income from employer-provided pension plans. Pensions offer regular monthly payouts and often come with survivor benefits. Understanding particular plan details, such as vesting periods and payout options, is crucial for effective financial planning.

Retirement Savings Accounts

Accounts like 401(k)s and IRAs are cornerstone retirement savings options. These tax-advantaged accounts allow individuals to save money during their working years, withdrawing funds during retirement. Planning withdrawals strategically is vital to minimize taxes and avoid penalties.

Annuities

Annuities provide a fixed income stream for retirees, based on an initial investment. Insurance companies offer various annuity products, including immediate or deferred annuities. While potentially offering lifetime income, it’s important to assess fees and contractual terms carefully.

Home Equity

For homeowners, tapping into home equity is an option for supplementing retirement income. Home equity loans and reverse mortgages are common methods to access home value, particularly for those with limited savings but significant property investments.

Government Programs

Various government programs offer financial assistance or services to seniors, including Medicare for healthcare needs and Medicaid for low-income individuals. Understanding eligibility criteria and enrollment processes ensures seniors take advantage of available benefits.

Disability and Survivor Benefits

For individuals unable to work due to disability, Social Security Disability Insurance (SSDI) offers financial support. Additionally, survivor benefits assist families when a spouse or parent passes away. It’s prudent to explore these benefits to maximize potential support.

Long-Term Care Insurance

Long-term care insurance covers expenses not typically included in standard health insurance, such as nursing home or in-home care. Purchasing a policy helps offset potential high costs associated with long-term care and protects other financial resources.

Planning for financial security as a senior involves diversifying income sources and making informed decisions. By understanding these financing options, seniors can develop a strategy that ensures stability, empowering them to focus on enjoying their retirement to the fullest.

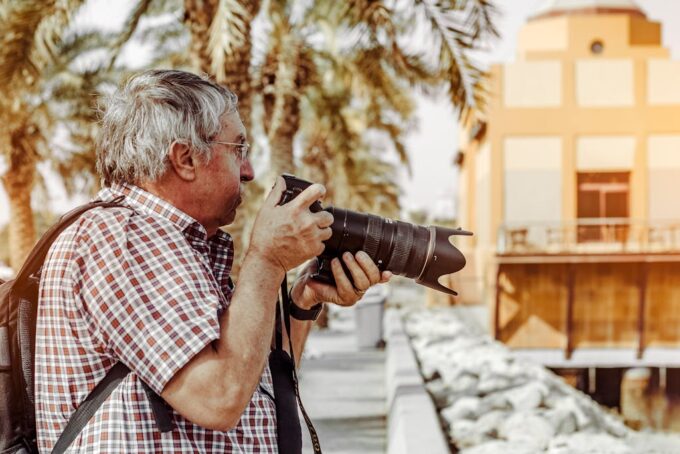

Top Senior Travel Tips for Comfort

Traveling can be a rewarding experience at any age, offering new adventures,...

Choosing the Right Senior Living Community

Deciding on the right senior living community is a significant step for...

How Stair Lifts Improve Home Safety

For individuals with mobility challenges, navigating stairs can be one of the...

Benefits of Electric Folding Wheelchairs

Electric folding wheelchairs offer increased mobility and independence for individuals with limited...